The Global Infrastructure Sustaining Turkey’s Illegal Online Betting Market

By Erdem / 04/06/25

In Turkey, illegal betting activities have evolved into increasingly invisible and complex structures, facilitated by the digital age. While these operations may initially appear as locally organized crime networks, they are, in fact, components of a multinational organization. Supported by global licensing, software, and gaming providers, this system continues to grow by exploiting legal loopholes and economic vulnerabilities within Turkey.

In Turkey, illegal betting activities have evolved into increasingly invisible and complex structures, facilitated by the digital age. While these operations may initially appear as locally organized crime networks, they are, in fact, components of a multinational organization. Supported by global licensing, software, and gaming providers, this system continues to grow by exploiting legal loopholes and economic vulnerabilities within Turkey.

Illegal betting websites are not merely simple platforms limited to a domain name. Behind them lies a multi-layered system comprising hundreds of professional software teams, financial engineers, and content producers. This system achieves both invisibility and a user experience competitive with legal platforms through licenses obtained from various countries, advanced digital infrastructures, and integrated payment methods.

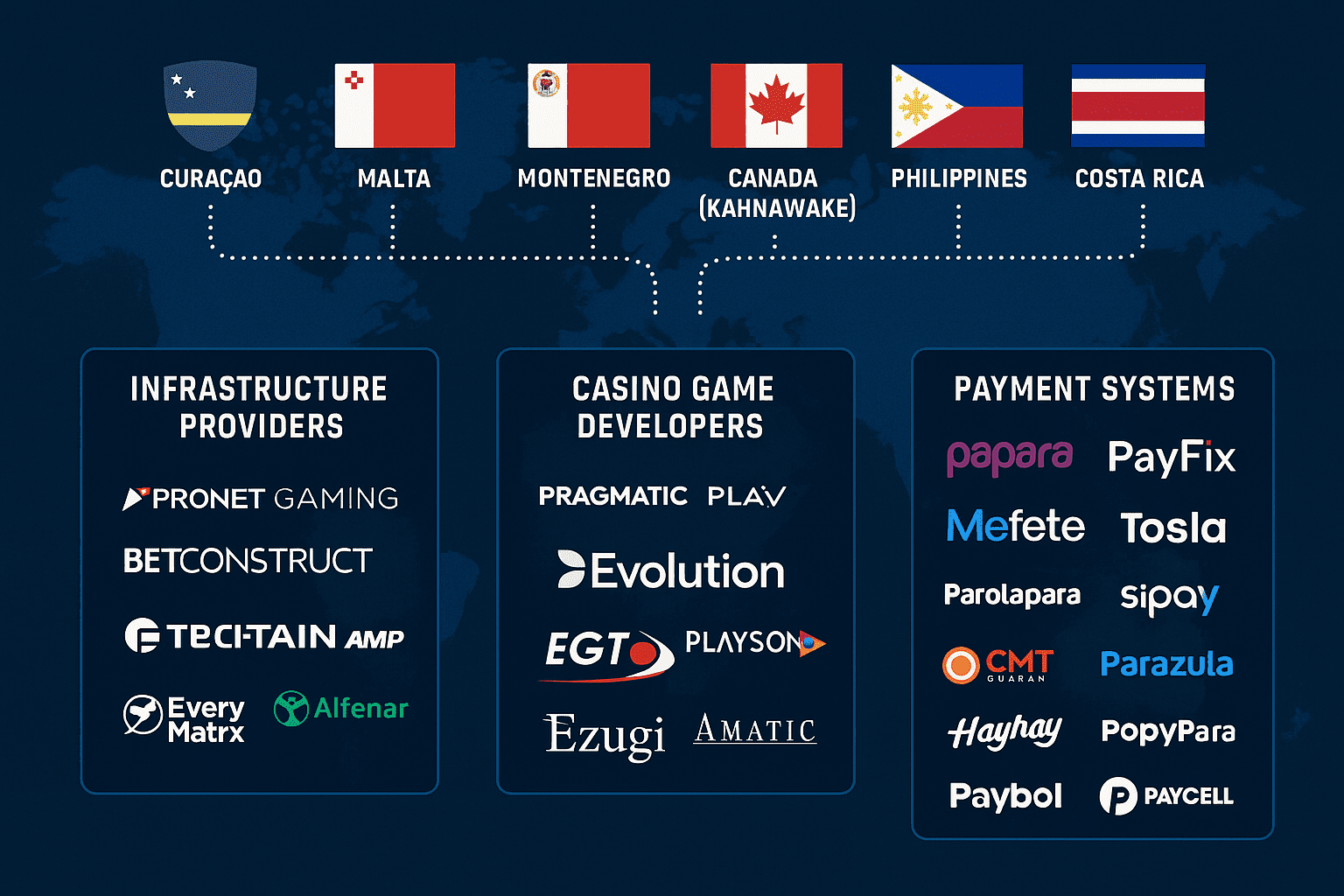

The strength of this market in Turkey is not solely due to local actors; it also involves globally active companies and countries with sectoral expertise. Three fundamental components stand out: licensing countries, infrastructure providers, and game developers. Each is an indispensable part of this extensive system.

License Providers to Turkey’s Illegal Betting Market

The expansion of Turkey’s illegal betting market is significantly influenced by licenses provided by certain countries. These licenses grant websites a semblance of legality, enhancing user trust and enabling access to payment systems. However, the regulatory structures and oversight mechanisms of these licensing countries vary greatly. Below are details about frequently used licensing countries by illegal betting sites operating in Turkey:

The expansion of Turkey’s illegal betting market is significantly influenced by licenses provided by certain countries. These licenses grant websites a semblance of legality, enhancing user trust and enabling access to payment systems. However, the regulatory structures and oversight mechanisms of these licensing countries vary greatly. Below are details about frequently used licensing countries by illegal betting sites operating in Turkey:

- Curaçao: Known for its low-cost and swift licensing process, Curaçao requires companies to establish a local entity, appoint a local representative, and host at least one physical server on the island. While it mandates certified gaming software and AML/CFT procedures, its licenses are often criticized for limited oversight and transparency, benefiting malicious operators.

- Malta: As an EU member, Malta offers highly reputable and strictly regulated licenses through the Malta Gaming Authority (MGA). Applicants must demonstrate financial stability, present detailed business plans, and ensure technical systems comply with MGA standards. Depending on the license type, minimum capital requirements range from €40,000 to €100,000.

- Montenegro: Recently less favored, Montenegro requires companies to establish a local entity and meet specific capital requirements, such as €75,000 for slot machines and a €25,000 bank guarantee. Online gaming licenses are typically tied to land-based casino licenses, posing additional challenges for operators.

- Canada (Kahnawake): Situated in Quebec, the Kahnawake Mohawk Territory issues online gaming licenses requiring local servers, certified software, and clean criminal records for company executives. The application fee totals $40,000, covering both the application and first-year license fees. Despite stricter oversight, some operators exploit legal gaps.

- Philippines: Through PAGCOR, the Philippines has issued online gaming licenses. However, recent government actions have banned offshore gaming operators (POGOs) due to associations with crimes like money laundering and human trafficking, diminishing the international credibility of these licenses.

- Costa Rica: Technically, Costa Rica doesn’t offer online gaming licenses but provides “data processing licenses” allowing companies to operate legally abroad. These licenses don’t authorize gaming operations and are often deemed insufficient by payment providers and game developers, making them more suitable for small-scale or temporary operators.

- Other Licenses: Countries like the UK, Germany, and Sweden offer highly regulated gaming licenses. Due to high costs, extensive legal requirements, and mandatory transparent reporting, illegal betting sites in Turkey avoid these jurisdictions, opting for more lenient and cost-effective regions, creating an illusion of legality in the market.

Infrastructure Providers to Turkey’s Illegal Betting Market

Companies supplying digital infrastructure to illegal betting sites in Turkey play a crucial role in the market’s growth. They offer “turnkey” solutions, enabling individuals without technical expertise to easily set up betting and casino sites. Prominent infrastructure providers include:

- Pronet Gaming: Established in 1996 and based in London, Pronet Gaming offers online and retail betting solutions with customizable platforms for various markets. Allegedly, betting tycoon V.Ş. owns Pronet Gaming.

- BetConstruct: Founded in 2003 by Vahe Badalyan, BetConstruct provides online and land-based gaming solutions, including sports betting, live betting, casino, poker, and virtual sports.

- Digitain: Established in 1999 and headquartered in Armenia, Digitain offers sports betting and iGaming platform technologies with modular and customizable solutions. They have become increasingly active in Turkey in recent years.

- EveryMatrix: Founded in 2008 and based in Malta, EveryMatrix offers services in casino, sports betting, payment solutions, and affiliate management, known for modular and scalable solutions. Sites using this infrastructure have also been linked to V.Ş.

- Altenar: Established in 2015 and headquartered in Malta, Altenar specializes in sports betting software and management, serving licensed gaming operators. Recently, many illegal betting sites in Turkey have utilized Altenar’s services.

- Betb2b: Known among Turkish illegal bettors as having “X-based infrastructure,” this company was founded in 2022 and is reportedly based in Limassol. It offers services in sports betting and casino gaming, though detailed information is scarce.

Casino Game Providers to Turkey’s Illegal Betting Market

A standout feature of illegal betting sites is the integrated casino games, predominantly supplied by international game developers. Common providers in Turkey’s illegal platforms include NetEnt, Pragmatic Play, Evolution Gaming, EGT, Playson, Ezugi, and Amatic.

- NetEnt: Established in 1996 in Sweden, NetEnt is renowned for its slot and table games.

- Pragmatic Play: Offers a wide range of content, including slots, live casino, bingo, and virtual sports, and is known for games like “Candy Game” and “Grandfather Game” among Turkish players.

- Evolution Gaming: Founded in 2006, specializing exclusively in live casino content, leading in categories like live roulette, blackjack, and game shows.

- Ezugi: A subsidiary of Evolution, providing live casino games.

- EGT, Playson, Amatic, Habanero, Wazdan: These companies offer slot and table games, enhancing the content diversity of illegal sites.

These developers typically distribute their content through infrastructure providers rather than directly to site owners. Operating on a per-game commission model, they generate significant revenue from illegal markets.

Payment System Providers to Turkey’s Illegal Betting Market

A critical factor in the sustainability of illegal betting sites in Turkey is the ability to conduct financial transactions swiftly, easily, and without oversight. Digital wallets and electronic money institutions play a significant role in this process.

Users have increasingly utilized various methods, from bank transfers to cryptocurrencies, to fund these sites. Digital wallet systems have become particularly prominent, allowing users to transfer money to betting sites through wallets opened in their names.

Major digital wallet and payment systems frequently used for depositing funds into illegal betting sites in Turkey include:

- Papara

- PayFix

- Mefete

- Tosla

- Parolapara

- Sipay

- CMT Cüzdan

- Parazula

- HayHay

- PopyPara

- Paybol

- Paycell

While all these services operate legally in Turkey, users often employ them as intermediaries to fund betting sites. In some cases, funds are sent to intermediaries via these platforms, making the transactions appear as personal transfers, while in reality, they channel money into organized betting networks.