Daily Crypto Transfer Limit Lowered to 3.000 USDT as Turkey Fights Illegal Gambling

By Erdem / 25/06/25

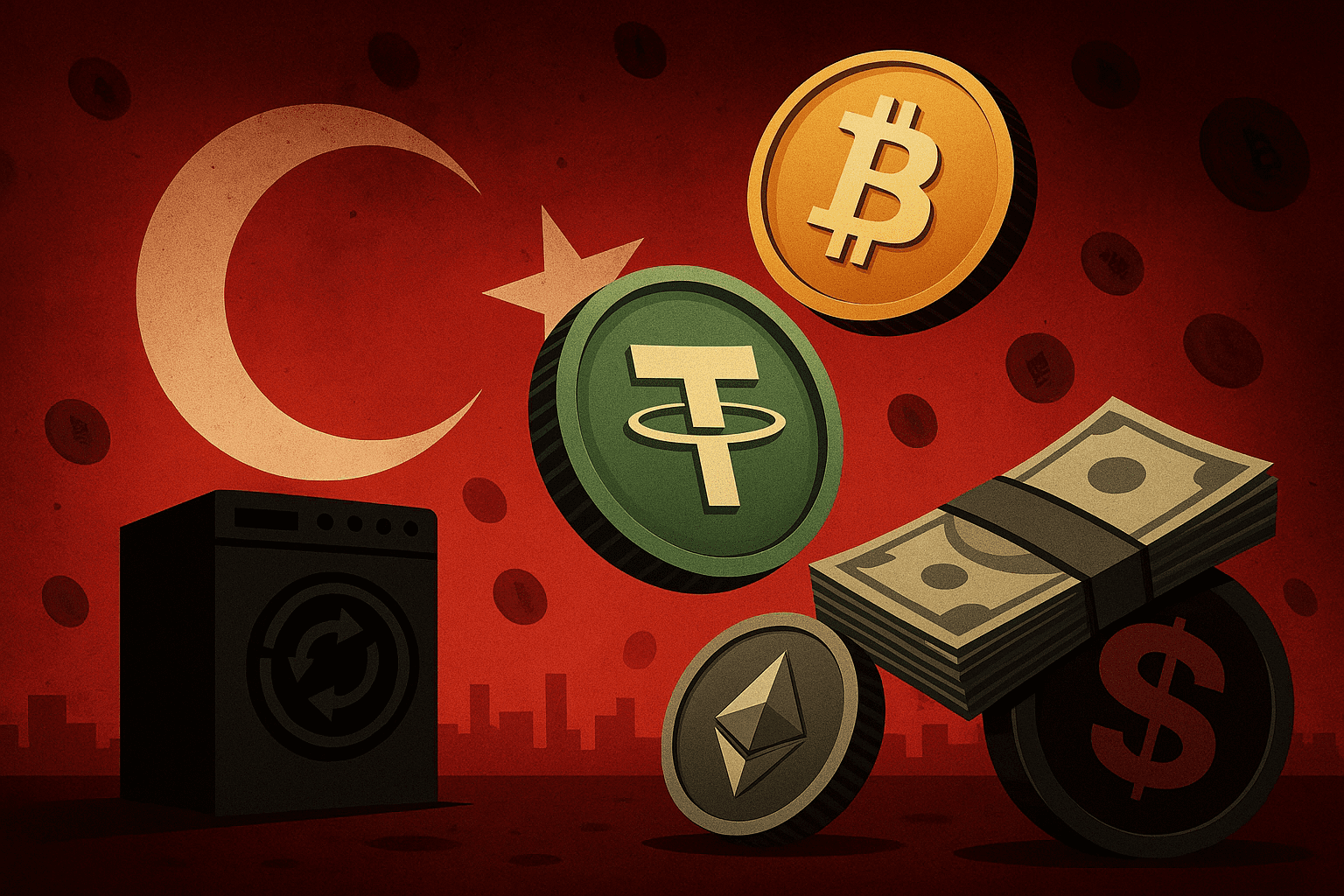

Turkey has introduced strict new regulations in 2025 aimed at curbing money laundering through cryptocurrencies, particularly in connection with illegal betting activities. The Ministry of Treasury and Finance has announced a series of measures intended to increase the transparency and traceability of crypto transactions. In recent years, a significant portion of illegal gambling revenues in Turkey have been funneled through cryptocurrencies, circumventing the traditional banking system. This has led authorities to focus their anti-money laundering efforts on the digital asset market.

Turkey has introduced strict new regulations in 2025 aimed at curbing money laundering through cryptocurrencies, particularly in connection with illegal betting activities. The Ministry of Treasury and Finance has announced a series of measures intended to increase the transparency and traceability of crypto transactions. In recent years, a significant portion of illegal gambling revenues in Turkey have been funneled through cryptocurrencies, circumventing the traditional banking system. This has led authorities to focus their anti-money laundering efforts on the digital asset market.

With the new regulations, crypto users will now be required to provide transaction descriptions, face restrictions on large stablecoin transfers, and experience mandatory waiting periods before withdrawing funds. These measures are expected to significantly hinder the rapid movement of funds used by illegal betting networks. Additionally, the move is part of Turkey’s effort to comply with international financial transparency standards and to exit the FATF grey list.

First Steps Against Illicit Betting Profits: Mandatory Descriptions & Withdrawal Delays

One of the most striking features of the new policy is the requirement for a written description on every crypto transaction. Users must now provide a minimum 20-character explanation for each transaction. This is designed to reduce the anonymity of transfers linked to illegal gambling sites and help regulators quickly detect suspicious activity.

Furthermore, crypto withdrawals can no longer be processed immediately. Users must wait at least 48 hours after depositing or trading assets on an exchange before they can withdraw. For new users, this waiting period can extend to 72 hours. These delays are meant to combat “flash cash-out” tactics commonly used in illegal betting operations.

Stablecoin Transfer Limits Narrow the Path for Gambling Revenues

Illegal betting organizations have increasingly relied on converting earnings into stablecoins such as Tether (USDT) and USD Coin (USDC) to move funds out of the system discreetly. This unregulated freedom is now coming to an end. Under the new rules, users may only transfer up to $3,000 in stablecoins daily and $50,000 monthly.

These restrictions present a major obstacle for high-volume operators attempting to move large sums. Only platforms that fully implement the Travel Rule will be permitted to offer double these limits, incentivizing both domestic and foreign exchanges to improve transparency. In short, laundering large amounts of money through stablecoins will become much more difficult.

Stronger Oversight: New Duties for Exchanges and Users

Another critical aspect of the new policy is tighter oversight of crypto asset service providers. The Ministry of Treasury and Finance, along with MASAK (Turkey’s Financial Crimes Investigation Board), will closely monitor exchanges that lack strong KYC protocols or fail to meet international compliance standards.

Key obligations for platforms and users include:

- Mandatory KYC: All users must undergo complete identity verification.

- Suspicious Activity Reporting: Exchanges must notify MASAK of large, unexplained, or unusual transactions.

- Travel Rule Implementation: Sender and receiver information must be included in transaction data.

- Sanctions for Non-Compliant Platforms: Penalties may include license revocation, fines, and bans on operating in Turkey.

These rules apply not just to domestic platforms but also to foreign exchanges serving Turkish users. Individuals attempting to convert illegal betting proceeds into crypto will face increased scrutiny.

Will These Measures Work? Can Illegal Gambling Still Find a Way?

Turkey’s crypto transfer restrictions in the second half of 2025 are a significant step toward preventing the laundering of gambling revenues through digital assets. But the key question remains: Will these efforts succeed in the long term?

📈 In the short term, the measures may:

- Slow down high-volume illicit transfers

- Disrupt “cash out quickly” laundering strategies

- Improve compliance with global AML standards

- Place more responsibility on platforms and users

🕳️ But in the long term, vulnerabilities may include:

- Continued access to unregulated decentralized exchanges (DEXs)

- Untraceable peer-to-peer (P2P) transfers

- Rise of physical stablecoin trading

- Users exploiting VPNs and foreign exchanges

- Enforcement capacity lagging behind regulatory intent

🧩 So what’s the real solution?

The problem is structural, not just technical. The root cause of Turkey’s booming illegal betting economy is that most sports betting is still conducted outside the legal framework. Leading countries have tackled this with:

- ⚽ A legal, regulated sports betting market (UK, Germany, Brazil)

- 💸 Taxable, traceable winnings

- 🧾 Registered users under legal protections

- 👮 Enforcement focused on organized crime, not individual users

🧠 Patchwork Fix or Real Reform?

While technical regulations on crypto can reduce risks, they won’t eliminate the shadow economy of illegal gambling. Real reform requires the establishment of a legal, transparent, and accountable betting ecosystem. As long as underground markets remain more attractive than legal alternatives, criminals will find new ways to adapt.

These crypto measures may be a necessary first step—but they must be followed by broader structural reforms to truly dismantle the illegal gambling economy.